Genesis Vaults

Investment Objective

Struct Finance's USDC Genesis Vaults leverage GMX’s GLP (Liquidity Provider Token) to offer stable, predictable yield within the volatile DeFi space. By utilizing USDC as collateral and capitalizing on opportunities within the GMX ecosystem, these Vaults balance the benefits of DeFi with effective risk management.

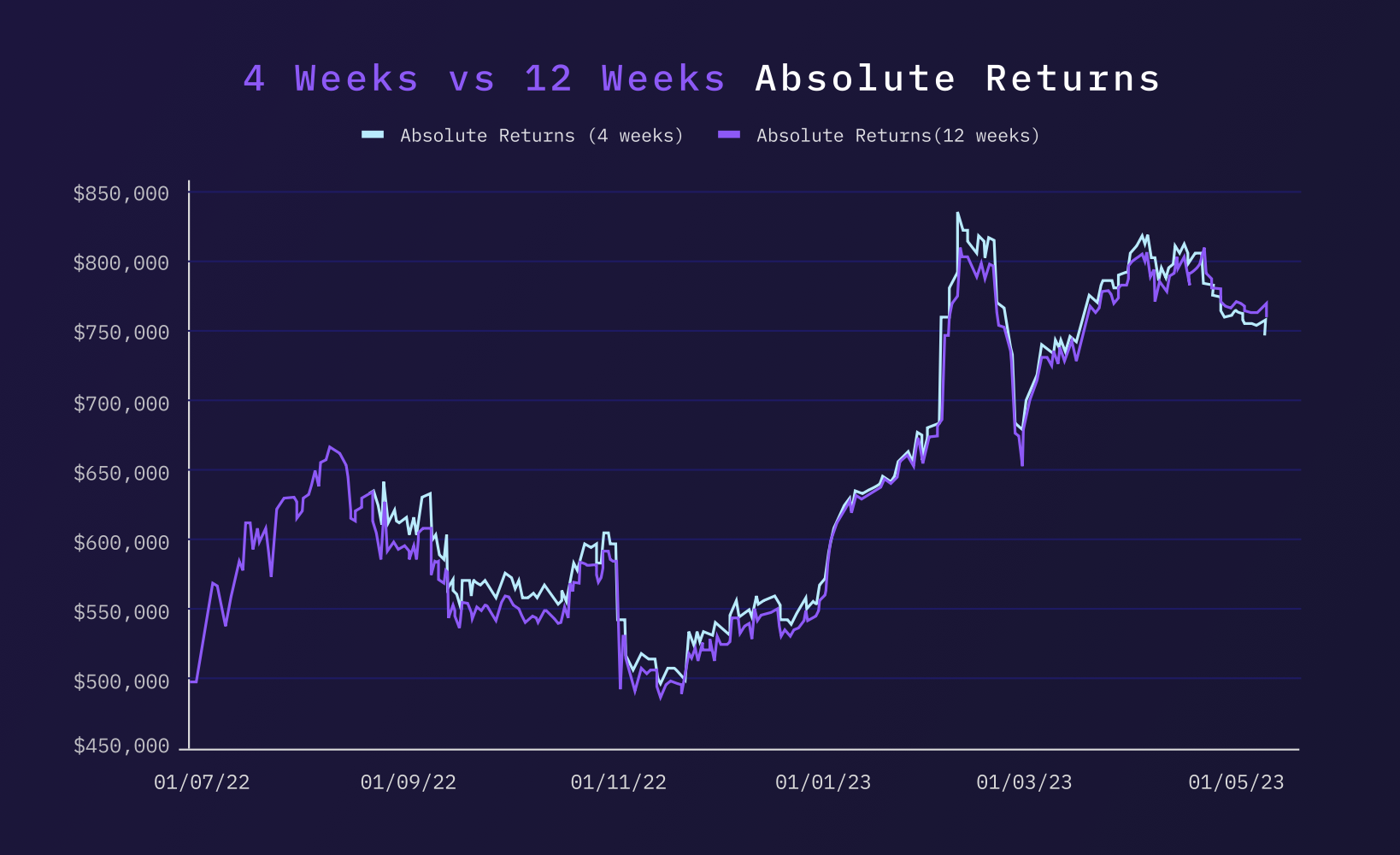

Available in 1-month and 3-month terms, each Vault is divided into two tranches: a fixed return tranche for conservative investors, and a variable return tranche for investors seeking higher potential returns. This dual-tranche approach, catering to differing risk profiles, offers an optimal balance of risk and reward.

Investment Summary

A cornerstone of the Genesis Vaults is tranching. Each Vault, be it a 1-month or a 3-month term, is segmented into two tranches, each designed to cater to a different risk profile. This methodology allows Struct Finance to tailor risk and return configurations based on investor preferences.

Tranching employs a 'waterfall mechanic' to distribute yield effectively. Initially, the yield is directed to the fixed return tranche, ensuring predictability for more conservative investors. Once yield commitments for this tranche are met, the additional yield flows into the variable return tranche, driving potential for higher returns for those with a larger appetite for risk.

Lastly, the strategy provides exposure to GMX's GLP token, an index of assets used for swaps and leveraged trading on the GMX platform. The GLP token serves as a vehicle to capture value from the GMX ecosystem, securing a sustainable yield for our investors. By facilitating liquidity for leveraged trading, investors have the opportunity to profit from trading fees and the overall performance of the index. This comprehensive strategy aims to deliver consistent, risk-adjusted returns to investors in the 1-month and 3-month USDC Genesis Vaults.