BTC.B-USDC Vaults

Investment Objective:

Utilizing Avalanche's BTC.B (Bridged Bitcoin) and USDC, these vaults are designed to offer predictable returns on Bitcoin investments. The objective is to balance higher yield generation than what's typically available in traditional Bitcoin investments, leveraging Avalanche’s BTC.B for DeFi applications.

The vaults are offered in 1-month, 2-month, and 3-month terms and have been structured to cater to different investor profiles. Each GMX vault is divided into two tranches: a stable senior tranche (BTC.B) for conservative investors, and a variable junior tranche (USDC) for investors with higher risk tolerance.

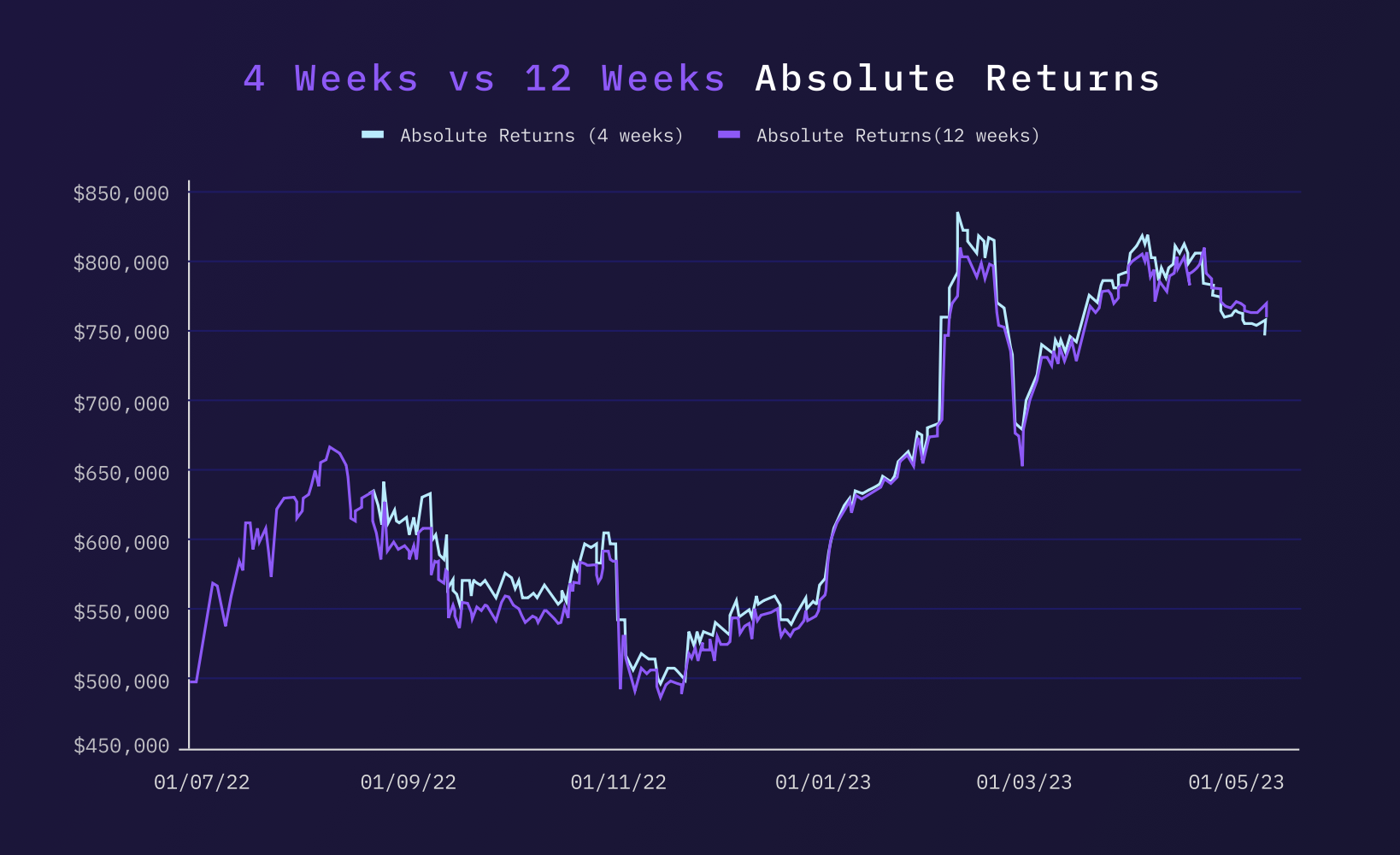

Absolute Returns

Investment Summary

The BTCB-USDC vaults use a dual-tranche system to distribute yield. The yield initially goes to the senior tranche (BTC.B), providing a steady and predictable return. Once the commitments for this tranche are fulfilled, any additional yield is redirected towards the junior tranche (USDC), opening up the possibility for higher returns.

The use of BTC.B in the senior tranche hedges the delta positive junior tranche. This is due to BTC.B in the senior tranche being converted into GMX's GLP token, which has a lower delta in relation to BTC.B. This conversion sets up a short Bitcoin position against GLP, contributing a negative delta for the junior tranche. Meanwhile, the USDC in the variable tranche is also converted into GLP which results in a positive delta for the junior tranche. This configuration effectively navigates the turbulent nature of the crypto market, resulting in lower volatility and max drawdown.

Yield Generation Mechanism

The GLP token's yield, referred to as "real yield," is generated from actual revenues rather than deflationary mechanics such as token emissions. Specifically, the yield accrues from three sources within the GMX platform: swap fees, perpetual interest, and liquidations. A substantial 70% of these fees go to the stakers of the GLP token.

The GLP token is composed of a diversified asset basket. By providing liquidity for leveraged trading, GLP holders stand to profit when leverage traders incur losses, and vice versa. Therefore, the GLP token serves not only as a robust and resilient investment vehicle but also as a sustainable source of yield.

Risk and Return Profile

The BTCB-USDC Vaults' dual-tranche structure accommodates different risk preferences. The senior tranche (BTC.B) guarantees the initial capital and offers a steady return, making it a suitable choice for investors with lower risk tolerance.

On the other hand, the junior tranche (USDC) carries higher market risk. This tranche starts generating yield only after the commitments to the senior tranche have been satisfied. During market downturns, the junior tranche absorbs most of the impact, thus shielding the senior tranche from significant losses. However, in favourable market conditions, the junior tranche has the potential to capture substantial profits as it accrues the remaining yield beyond the commitments to the senior tranche. In essence, Struct Finance's BTCB-USDC Vaults are designed to deliver tailored risk and return configurations based on investor preferences. This balance between risk mitigation and potential return on investment is achieved through the dual-tranche structure, offering a unique investment opportunity in the cryptocurrency market.